Keep the Government and Lawsuit Happy Opportunists Away From Your Children’s Inheritance

Feb 24, 2023

If you have a current estate plan, I'll bet you plan to leave your assets to your children outright and unprotected by age 35, or maybe a little later. Go take a look at your estate plan, and see what it does right now. And, if you don’t have an estate plan, and you have kids or other people you care about, contact us today and let’s get that handled for you.

If you do have a plan and it distributes your assets outright to your kids -- even in stages, over time, some at 25, then half of what’s left at 30, and balance at 35 (or something along those lines), you’ve overlooked d an incredibly valuable gift you can give your children (and the rest of your descendants for generations); a gift that only you can give them. And a gift that, once you’ve died and left them their inheritance outright, is lost and cannot be reclaimed.

Leave your kids a nest egg protected from lawsuits, divorce, and estate taxes.

While you may think to yourself, my kids’ inheritance doesn’t need to be protected. They aren’t going to get sued. You may be right, but you may also be overlooking one of the most common “lawsuits” that causes inheritances to be lost everyday, and that’s divorce. If you want to protect the money you are leaving to your children from their future divorces, even if you love their spouses nor or expect you will, in the future, you can easily do so using a protected trust.

And, if your child is ever involved in a lawsuit, for example, a simple car accident, or if a business transaction goes bad, what you leave to your child can be protected from all future lawsuits or claims against them.

The best part is that if your child has their own taxable estate when they die, your planning now could save your family 40 cents on every dollar (or more) handed down from one generation to the next.

Save your family Up to 40 cents on every dollar -- currently -- at each generation.

As of 2023, the current federal estate tax rate is 40% -- meaning that every dollar passed on over the estate tax exemption rate is taxed at 40%. And it has been as high as 55%. On top of that, many states have estate taxes as well.

This all adds up fast, and can decimate your family’s financial legacy, over time For every million dollars you leave outright to your children, if your children have a taxable estate when they die, could result in your grandchildren receiving only $550,000, with $450,000 going to the government ... unnecessarily.

So, if you want to know that everything you’ve worked so hard to create will stay in your family for generations to come and not be lost to outsiders, leaving your assets to your children protected in a trust we call a Lifetime Asset Protection Trust, instead of outright is the way to go. And, it can be easily built in to your existing estate plan or trust, you just need to ask us to help you get a Lifetime Asset Protection Trust added to your plan.

But how will my kids get to use what I leave to them?

Here’s the best part about leaving your assets to your children in a Lifetime Asset Protection Trust. Not only is what you leave protected, but your children control what you leave them when you decide they are ready.

After your death, the assets you leave behind will pass to your children (and your grandchildren, great-grandchildren, and so on for successive generations) in a Trust that your child can control, as the Trustee of the Trust. You can decide when your child is mature enough to act as a Trustee.

As the Trustee of the Trust, your child decides how what you’ve left is invested and what to do with the Trust assets. And your child will even be able to determine the amount of control vs. the amount of asset protection he or she wants based on his or her specific circumstances.

Is this still important if I don’t have much money?

If you only leave your children a small amount of money, this is still incredibly valuable for protection, if you are leaving assets that will be invested and grown, and not just spent right away on consumables. Some might say it’s even more important because your family has less to lose to taxes, lawsuits, and divorce each generation. And the impact of such losses is much greater.

A mere $10,000 protected now can become millions for the people you love for generations to come.

Imagine that you leave just $10,000 to your child in a Lifetime Asset Protection Trust, and instead of spending that $10,000 or losing it in a divorce, they invest that $10,000 in creating their own business inside their trust, and then grow that business into a million dollar or multi-million dollar venture because of how you chose to leave your child that $10,000 gift … and it’s fully protected for generations.

Secure the future of your family today by speaking to us, Personal Family Lawyer®. We review estate plans and inherited funds with you, ensuring that all legalities are in place so generations can enjoy the benefits according to your wishes. Don't wait, get peace of mind now - contact us today to get started.

*ADDITIONAL SUPPORT PACKAGES*

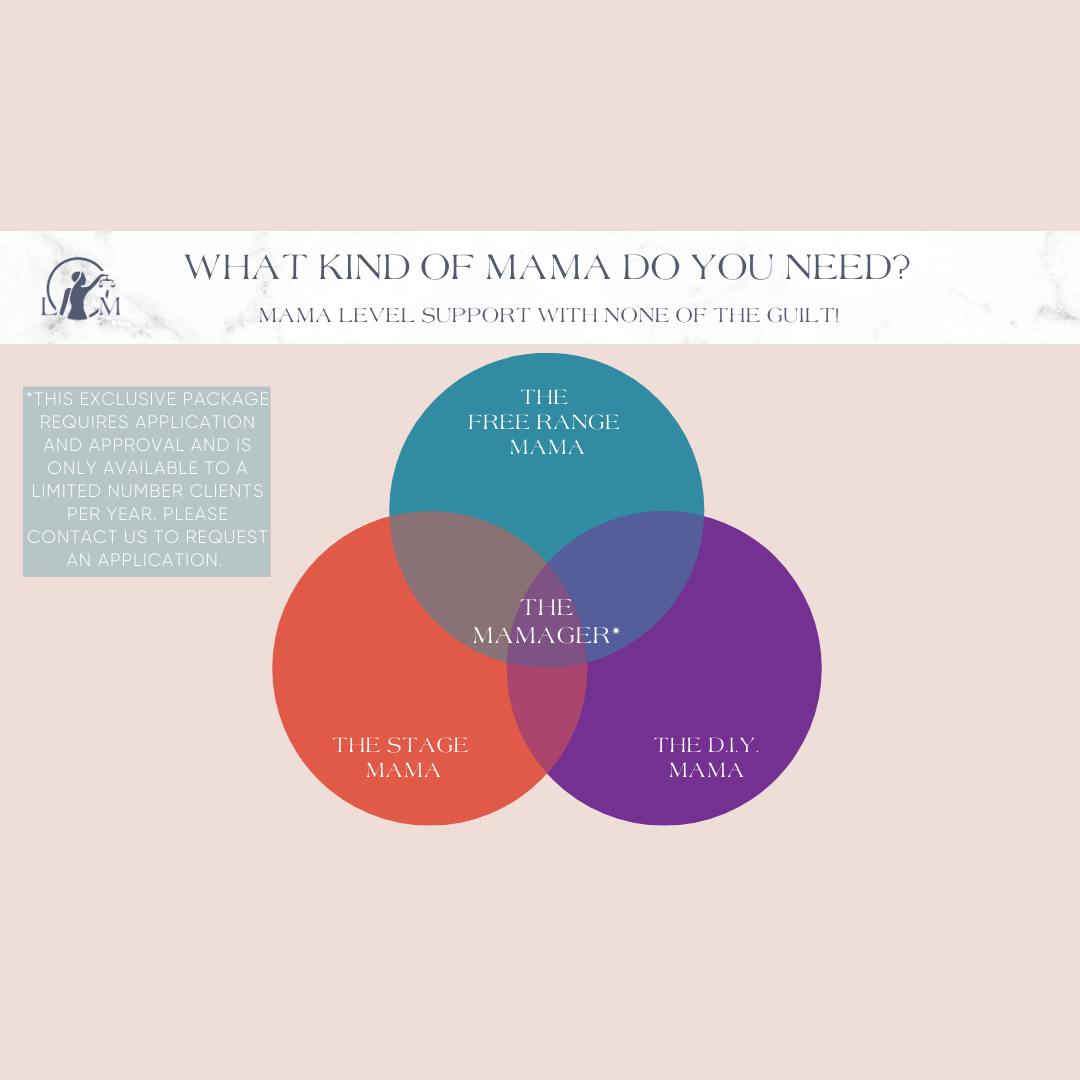

Have you been putting off planning because you simply don't have the time? Ask us about our LEGAL MAMA EASY BUTTON! You'll get our BEST plan with the MOST financial protections and any level of additional support with homework, funding, paperwork filling out, etc. What kind of Mama do YOU need?

*INTEREST FREE FINANCING THROUGH AFFIRM*

*THE FAMILY WEALTH PLANNING SESSION*

Click the photo to learn about my unique planning process, which starts with a Family Wealth Planning Session:

Many of the issues in today's article are addressed throughout membership with yearly family meetings. Once you finish your planning, we can help you keep your plan up-to-date and keep your family up to date as well. Membership also offers loads of perks like unlimited communication on your legal needs and more. Just one more way Legal Mama goes above and beyond as your Personal Family Lawyer for Life!

Feeling overwhelmed by the Estate Planning Process? Want an Estate Planning Life Hack? Sign up for "Sarah's Plan"! Our MOST comprehensive plan at our most reasonable price in a FRACTION of the time. All you have to do is fill out a handful of questions online, pay our discounted fee, and know that your planning is completely DONE! Want to discuss this option in 15 minutes or less? Schedule a free consultation call and we'll have your planning done in no time! Otherwise, follow this link to sign up for Sarah's Plan on the spot!

Next ONLINE Webinar:

This article is a service of Sarah Breiner, Personal Family Lawyer®. We don’t just draft documents; we ensure you make informed and empowered decisions about life and death, for yourself and the people you love. That's why we offer a Family Wealth Planning Session,™ during which you will get more financially organized than you’ve ever been before, and make all the best choices for the people you love. What is a Personal Family Lawyer®? A lawyer who develops trusting relationships with families for life.

You can begin by contacting Sarah today to schedule a Family Wealth Planning Session.

Stay connected with news and updates!

Join our mailing list to receive the latest news and updates from our team.

Don't worry, your information will not be shared.

We hate SPAM. We will never sell your information, for any reason.