Creditors And Your Estate Plan

Jan 11, 2023

What Happens To Your Debt When You Die?

Maybe you’ve wondered about your own debt or perhaps your parent’s debt—what happens to that debt when you (or they) die? Well, it depends, and that’s part of the reason you want to ensure your estate plan is well prepared. How you handle your debt can greatly impact the people you love.

In some cases, you could inadvertently leave a reality in which your surviving heirs—your kids, parents, or others—are responsible for your debt. Alternatively, if you structure your affairs properly, your debt could die right along with you.

According to the Federal Trade Commission, an individual’s debt does not disappear once that person dies. Rather, the debt must either be paid out of the deceased’s estate or by a co-creditor. And that could be bad news for you or the people you love.

What exactly happens to this debt can vary. One of the purposes of the court process known as probate is to provide a time period for creditors to make a claim against the deceased’s estate, in which case debts would be paid before beneficiaries receive their inheritance. But if there is nothing in the probate estate and all assets are held outside of the probate estate, then what?

Well, that’s where we come in, and why it’s so important to get your affairs in order, even if you have a lot more debt than assets. Your “estate” isn’t just what you own, it includes what you owe, too. And with good planning, we can help you align it all in exactly the way you want.

Debt After Death

When an individual dies, someone will handle his or her affairs, and this person is known as an executor. The executor can either be someone of the individual’s choice, if he or she planned in advance, or someone appointed by the court in the absence of planning. The executor opens the probate process, during which the court recognizes any will that’s in place and formally appoints the executor to administer the deceased’s estate and distribute any outstanding assets to their loved ones.

During this process, the estate’s assets are used to pay any outstanding debt. This usually includes all of an individual’s assets, although it does not include assets with beneficiary designations, such as 401(k) plans and insurance policies. The estate does not own these assets, and they pass directly to the named beneficiaries. Given these factors, if an individual’s assets are subject to probate and the person has outstanding debt, their beneficiaries will receive a smaller share of anything left to them in the estate plan.

How Unsecured Debts Are Handled After Death

Typically, unsecured debts, such as credit card debts, are the last form of debt the estate repays. In most cases, the estate first repays any outstanding secured debts, including car and mortgage loans. Following this, the estate repays the legal and administrative fees associated with executing the deceased’s will. From there, the estate repays any outstanding unsecured debt, including credit card balances. Usually, if the estate lacks the assets to repay these debts, creditors have no choice but to accept the loss.

However, in some states, probate laws may dictate how the deceased’s creditors can clear these debts in other ways, such as by forcing the sale of the deceased’s property. It’s worth noting that there is a time limit for creditors to claim against an estate after the deceased dies, and this time frame varies between states.

Avoiding Probate

There are several things you can do to avoid probate. Perhaps the most common involves establishing a revocable living trust. Since the trust, not the estate, owns the assets, assets held by a properly funded and maintained trust do not have to go through the probate process.

Despite this, creating a living trust does not guarantee an individual’s assets will receive protection from creditors if that person has debt. What it does mean is that his or her heirs may have more flexibility compared to probate. In other words, by creating a living trust, your trustee may be able to negotiate with creditors more easily to reduce any outstanding debt. In theory, creditors may still sue to repay the debt in full. However, since this could involve significant costs, creditors may prefer to settle instead.

When Do Surviving Family Members Pay The Deceased’s Debts?

Most of the time, it’s unnecessary for surviving family members to pay the deceased’s debt with their own money. Instead, as noted above, payment of the debts are either paid out of the deceased’s estate, or if there is no estate, the debts are extinguished. However, there are some exceptions to this, including the following:

- Co-signing loans or credit cards: If someone cosigns a loan or credit card with the deceased, that individual is responsible for clearing any outstanding debt associated with that account.

- Having jointly owned property: If an individual has jointly owned property or bank accounts with the deceased, that person is responsible for clearing any outstanding balances associated with these assets.

- Community property: In some states, including California, Arizona, Nevada, Louisiana, Idaho, Texas, Washington, New Mexico, and Wisconsin, the surviving spouse is required to clear any outstanding debt associated with community property. Community property is any property jointly owned by a married couple.

- State laws: Some states require surviving family members, or the estate more generally, to clear any debts associated with the deceased’s healthcare costs. Additionally, if the estate’s executor failed to follow a state’s probate laws, it might be necessary for him or her to pay fines for doing so.

What To Do When Someone Dies With Debt

When someone dies with outstanding debt, it’s important to take swift action to handle their affairs and negotiate their debts. Below are some steps to follow when faced with this scenario:

01 - Understand Your Rights

Since probate laws vary between states, it’s a good idea to thoroughly research the probate process in our state, or hire a lawyer to handle the estate for or with you. Many states require creditors to make claims within a specific period, while also requiring surviving family members to publicly declare the deceased’s death before creditors can collect any outstanding debt. It’s also against the law for creditors to use offensive or unfair tactics to collect outstanding credit debt from surviving family members. It’s generally a good idea to ask creditors for proof of any outstanding debt before paying.

02 - Collect Documents

Collecting documents can be fairly straightforward, particularly if the deceased left all their vital financial papers in a single location. If the surviving family members cannot locate these documents, they can request the deceased’s credit report, which lists any accounts in the deceased’s name. As your Personal Family Lawyer®, we can do this for you, as part of our post-death support services.

03 - Cease Additional Spending

This is essential to prevent any debts in the deceased’s name from increasing further, even if there is another person authorized to make payments. Ceasing additional spending. including canceling any recurring subscriptions, also helps prevent unnecessary complications when negotiating with creditors.

04 - Inform Creditors

Proactively contact the deceased’s creditors to look into options for negotiating the debt, and notify credit bureaus of the death. To complete this process, it’s useful to have several copies of the death certificate to share with insurance companies and creditors. Afterwards, ask to close all accounts in the deceased’s name, and request the credit bureaus freeze the deceased’s credit, preventing others from unlawfully getting credit in his or her name.

05 - Close The Estate

Once all debt has been paid off, forgiven, or extinguished, the executor can officially close the estate. The process for doing this varies based on how assets and debts were held, so do not go into this part alone. Contact us to find out how we can support you.

We Can Help Ensure Your Family Doesn’t Get Stuck With Your Debt

Effective estate planning involves taking care of your affairs, and this includes ensuring your debts will be handled in such a way that your family isn’t left with a big mess or inadvertently forced into court. Consider scheduling a Family Wealth Planning Session with us, your Personal Family Lawyer® to determine how we can help protect your assets and prevent creditors from reducing the gifts you want to leave your loved ones after death. Contact us today to learn more.

*ADDITIONAL SUPPORT PACKAGES*

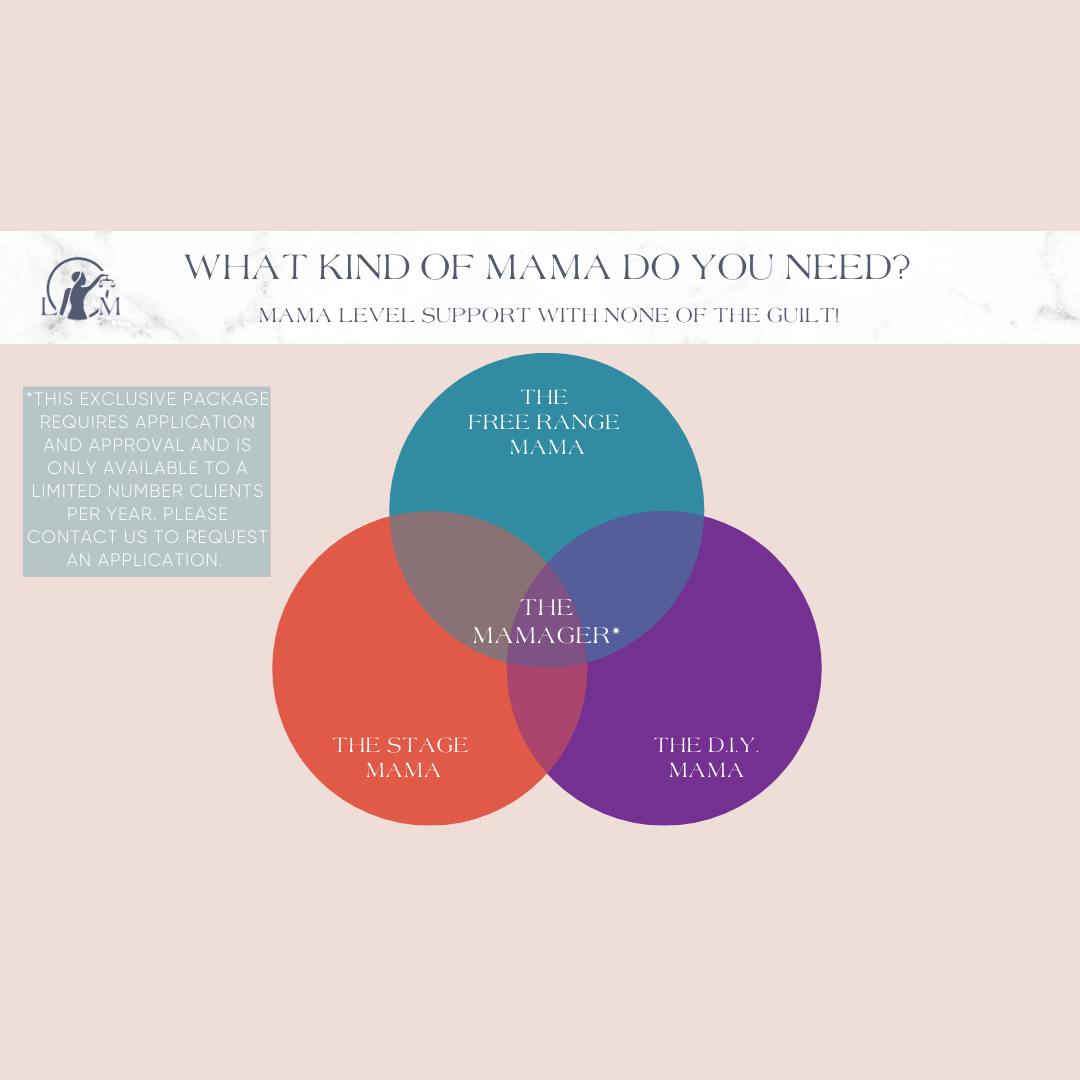

Have you been putting off planning because you simply don't have the time? Ask us about our LEGAL MAMA EASY BUTTON! You'll get our BEST plan with the MOST financial protections and any level of additional support with homework, funding, paperwork filling out, etc. What kind of Mama do YOU need?

*INTEREST FREE FINANCING THROUGH AFFIRM*

*THE FAMILY WEALTH PLANNING SESSION*

Click the photo to learn about my unique planning process, which starts with a Family Wealth Planning Session:

Many of the issues in today's article are addressed throughout membership with yearly family meetings. Once you finish your planning, we can help you keep your plan up-to-date and keep your family up to date as well. Membership also offers loads of perks like unlimited communication on your legal needs and more. Just one more way Legal Mama goes above and beyond as your Personal Family Lawyer for Life!

Feeling overwhelmed by the Estate Planning Process? Want an Estate Planning Life Hack? Sign up for "Sarah's Plan"! Our MOST comprehensive plan at our most reasonable price in a FRACTION of the time. All you have to do is fill out a handful of questions online, pay our discounted fee, and know that your planning is completely DONE! Want to discuss this option in 15 minutes or less? Schedule a free consultation call and we'll have your planning done in no time! Otherwise, follow this link to sign up for Sarah's Plan on the spot!

Next ONLINE Webinar:

This article is a service of Sarah Breiner, Personal Family Lawyer®. We don’t just draft documents; we ensure you make informed and empowered decisions about life and death, for yourself and the people you love. That's why we offer a Family Wealth Planning Session,™ during which you will get more financially organized than you’ve ever been before, and make all the best choices for the people you love. What is a Personal Family Lawyer®? A lawyer who develops trusting relationships with families for life.

You can begin by contacting Sarah today to schedule a Family Wealth Planning Session.

Stay connected with news and updates!

Join our mailing list to receive the latest news and updates from our team.

Don't worry, your information will not be shared.

We hate SPAM. We will never sell your information, for any reason.